In previous blog postings (here and here), I have addressed some of the key myths regarding international trade as well as the difficulties in determining whether U.S. exchange rates are over, under, or fairly valued. This posting addresses how the forces that drive globalization have changed and so has the distribution of income (in both global and advanced country terms.) Richard Baldwin’s new book The Great Convergence suggests that a major change in the forces of globalization took place around 1990. He divides economic history into three broad periods: pre-globalization (until 1820), globalization I (1820 to 1990), and globalization II (from 1990 to the present.)

The graphic below (from a recent Baldwin’s presentation) displays the three primary forces that affect the magnitude and character of globalization.

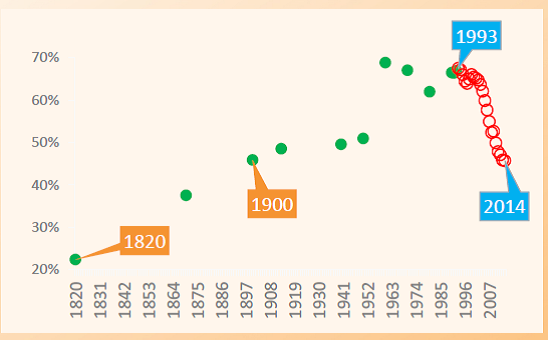

The invention and adoption of steam power removed a major barrier to the movement of goods. Baldwin suggests roughly 1820 as the point at which the power of the industrial revolution and its potential for scale economies led to the great divergence of incomes between the industrialized world (G7) and poor countries. He argues that production grew in the G7 and companies in the same industry competed with each other to innovate. As Michael Porter argues in the Competitive Advantage of Nations, the G7 countries established clusters of related manufacturing activities that were (price and quality) competitive domestically and whose products were attractive to the rest of the world; thus, as shipping costs fell, production and income grew rapidly. Lance Pritchett of the World Bank called this “Divergence Big Time.” These patterns lasted until the early 1990s. As Baldwin’s chart below shows , the differences in the industrialized countries’ (G7) share of world GDP grew from a little over 20% in 1820 to roughly 70% by the mid 1960s, where it stayed until the 1990s when communication costs fell rapidly.

G7 Share of World Gross Domestic Product

Information and communication technology (ICT) allowed G7 firms to begin to cheaply share their technology and knowledge. To stay competitive, firms needed to reduce their costs of production. They did this by building global supply chains in which they produced different portions of their output in different countries based on the cost of labor. The skill levels needed to employ much of the technology used in the G7 could be found in developing countries in general and in East Asia in particular for much lower wages; thus, the clusters that led to providing countries with comparative advantages in particular products were disrupted by outflow of many stages of production. Firms no longer needed to be tied to particular locale; they built what Baldwin calls Global Value Chains, which feature off-shored factories and knowledge outflows from the G7 countries to serve these global enterprises.

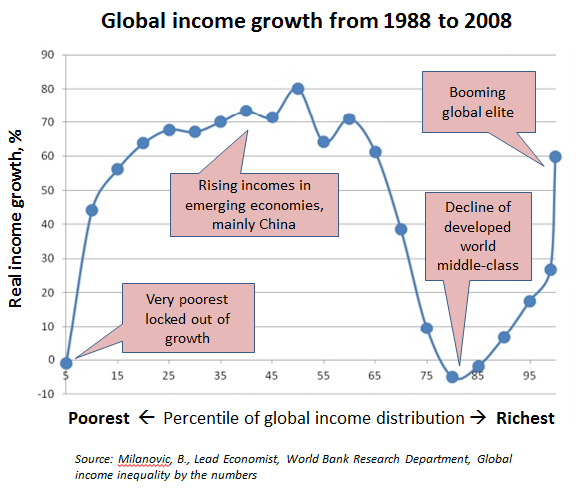

Clearly, intermediate skilled labor in the headquarter economies lost out and knowledge workers gained from ICT’s disruptive innovation. In the emerging market economies, incomes and the middle class increased markedly, and poverty fell precipitously. Branko Milanovic’s “elephant” chart shows these results quite clearly.

This is what Baldwin calls the Great Convergence. To explore the consequences for public policy, he poses two major questions;

- Will US manufacturing stages rebundle?

- If so, where will it take place (in the US? Abroad?)

Since roughly half of what is imported by the US goes into the production process, tariffs on such imports, as suggested by President Trump and others, will only make US-based production less competitive. Such tariffs might also lead to moving more production to where goods are sold as well as to retaliatory action by those countries upon which tariffs are imposed. In short, rebundling of manufacturing in the U.S., at least in terms of middle income employment, is unlikely.

How does Baldwin suggest public policy should respond to the new globalization?

- Accept contemporary reality of the new globalization since the old tools – quotas and tariffs – will not bring back prosperity and middle income jobs.

- Rebuild social cohesion, through appropriate safety nets, and improve our ability to compete, through retraining, education, and incentives.

Many of his suggestions mesh well with those provided by Brynjolfsson and McAfee in the Second Machine Age and reviewed here. I encourage you to read Baldwin’s marvelous book or at least peruse the related slides.

3 thoughts on “A Second Globalization Features The Great Convergence”